Shield Your Home: Unveiling the Power of Home Insurance

Welcome to our comprehensive guide on home insurance, where we will unveil the power and importance of this essential coverage for your most cherished investment. Your home holds both sentimental and financial value, making it crucial to safeguard it against unforeseen events. Home insurance provides a protective shield, allowing you to breathe a sigh of relief knowing that you have a safety net in place. In this article, we will explore the various facets of home insurance, including contractor insurance, general liability insurance, bonds insurance, and workers comp insurance. Join us as we delve into everything you need to know to make informed decisions and shield your home effectively.

Understanding Home Insurance

When it comes to protecting your most valuable asset, home insurance plays a crucial role. Whether you own a house or a condominium, having the right insurance coverage is essential to safeguarding your investment. Home insurance provides financial protection against unexpected events such as fire, theft, natural disasters, and other perils that may damage or destroy your property.

One important aspect of home insurance is the coverage it provides for your personal belongings. In the unfortunate event of a covered loss, your policy can help reimburse you for the cost of replacing or repairing damaged furniture, appliances, electronics, and other valuables. It’s important to carefully review your policy to understand the limits and exclusions related to personal property coverage.

Another key feature of home insurance is the liability protection it offers. Accidents happen, and if someone is injured or their property is damaged while on your premises, your home insurance can help cover the associated medical expenses or legal fees. This liability coverage can give you peace of mind knowing that you are protected against unexpected lawsuits that may arise from accidents on your property.

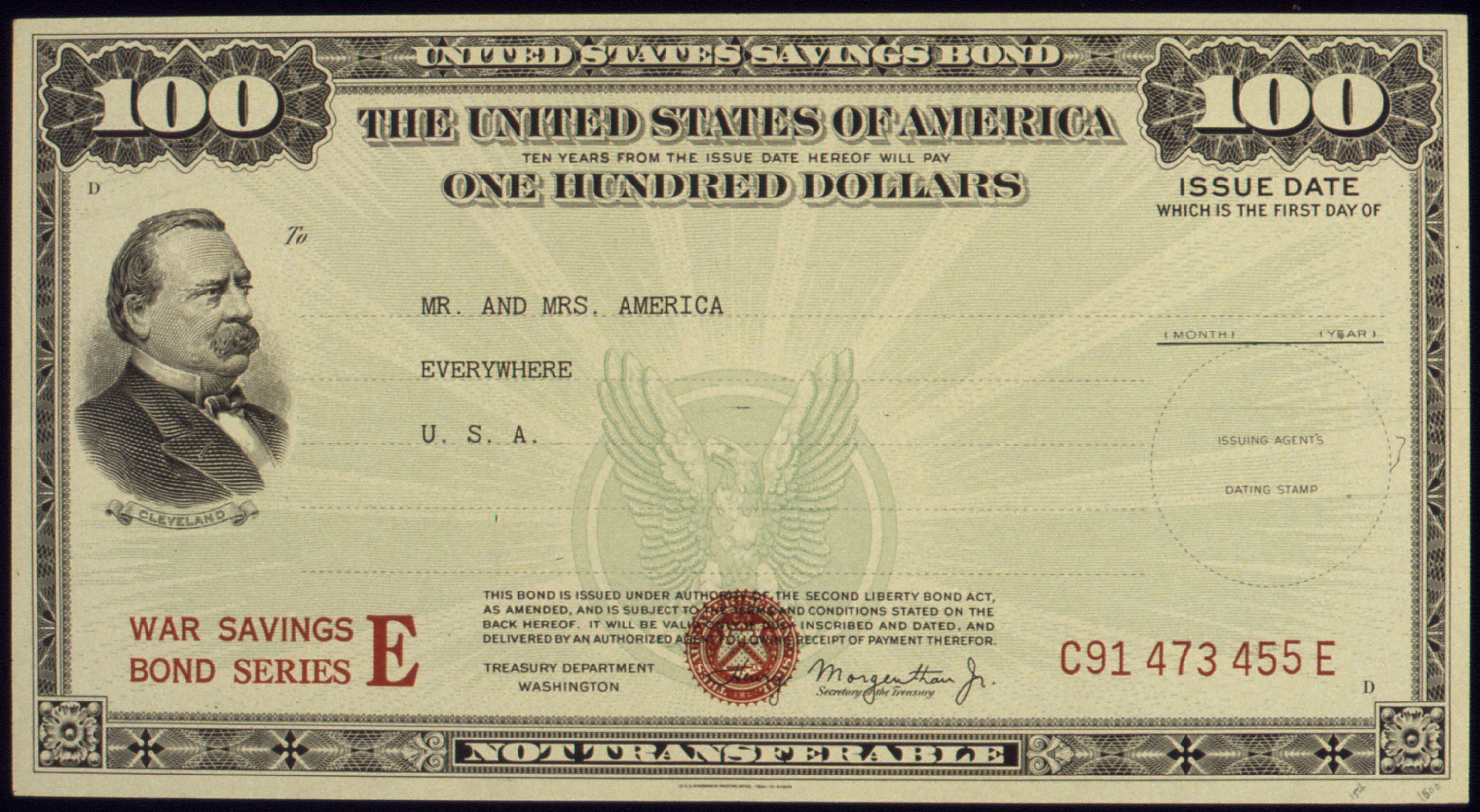

In addition to these familiar coverages, it’s worth considering specialized insurance options that may cater to your unique needs. Contractor insurance, general liability insurance, bonds insurance, and workers comp insurance are examples of additional coverages that can be tailored to homeowners who hire contractors for home improvement projects. These policies provide specific protections for both the homeowner and the contractor, ensuring that any risks or accidents that may occur during the project are adequately covered.

Home insurance is not just a recommended step in homeownership; it is an essential investment that provides financial security and peace of mind. By understanding the different aspects of home insurance and exploring additional coverages that suit your specific requirements, you can confidently shield your home from unforeseen events and protect your property, belongings, and loved ones.

Exploring Contractor Insurance

When it comes to protecting your home, contractor insurance plays a vital role. It ensures that you are safeguarded against any potential risks and liabilities that may arise during the course of construction or renovation projects. Without adequate coverage, you could be held responsible for accidents, damages, or even lawsuits. That’s why having contractor insurance is essential to shield your home and your finances.

Contractor insurance typically includes several types of coverage, such as general liability insurance, bonds insurance, and workers’ compensation insurance. General liability insurance provides protection against property damage, bodily injury, and any legal claims that may arise due to accidents or negligence on the part of the contractor or their employees.

In addition to general liability insurance, bonds insurance is also crucial for contractors. It acts as a guarantee to clients that the contractor will fulfill their obligations and complete the project as agreed. Bonds insurance helps build trust between the homeowner and the contractor, ensuring that both parties are protected financially.

Furthermore, workers’ compensation insurance is a key component of contractor insurance. This coverage provides benefits to employees who sustain injuries or illnesses while working on your home. With workers’ compensation insurance in place, you won’t be held liable for medical expenses or lost wages in case of workplace accidents.

By having comprehensive contractor insurance, you can rest easy knowing that your home and your investment are well-protected. It gives you peace of mind, allowing you to focus on the completion of your project without worrying about unforeseen circumstances. Remember, when it comes to home renovations or construction, it’s always better to be safe than sorry.

Insights into General Liability Insurance

General Liability Insurance is an essential component of home insurance coverage. It offers protection against third-party claims for bodily injury, property damage, or personal injury that may occur on your property. Without this coverage, you could be faced with significant financial burdens if accidents or lawsuits arise.

Contractors and homeowners alike can benefit from General Liability Insurance. For contractors, this coverage provides protection in case of accidents or property damage that may occur during construction or renovation projects. Homeowners, on the other hand, can rest easier knowing that they are protected if someone is injured while on their property or if their property is damaged as a result of someone else’s actions.

One important aspect of General Liability Insurance is that it typically includes coverage for legal defense costs. This means that if a lawsuit is filed against you, the insurance company will provide representation and cover the costs associated with defending your case in court. This can be particularly valuable as legal expenses can quickly add up, even if the claim against you is ultimately unfounded.

In summary, General Liability Insurance is a crucial part of home insurance that provides protection against third-party claims for bodily injury, property damage, or personal injury. It offers peace of mind to both homeowners and contractors, ensuring that they are financially protected in case of accidents or lawsuits. With the right coverage in place, you can shield your home and safeguard your finances.